Buildings

2025

| Report

Many real estate investors are looking to align building investments with sustainability goals, meet regulatory requirements, and drive long-term asset value creation. In this paper, we highlight replicable solutions to help real estate investors move…

Africa

2026

| News / Announcement

Nigerian Businesses, RMI, and the Global Energy Alliance for People and Planet Collaborate to Empower Women and Youth Through Renewable Technology The Energising Women & Youth in Agri-Food Systems Programme (EWAS), a collaboration between local businesses and RMI,…

India

2026

| Article

Shipping routes that use zero-emission fuels are a critical mechanism to aggregate maritime demand for green fuels and decarbonize the shipping sector.

US Policy

2026

| Page

Energy costs are squeezing households nationwide. RMI’s Affordability Hub helps leaders make energy more affordable and end energy poverty.

China

2026

| insight

Industrial park, zero-carbon industrial park, zero-carbon park…

Climate Data

2026

| Spark Chart

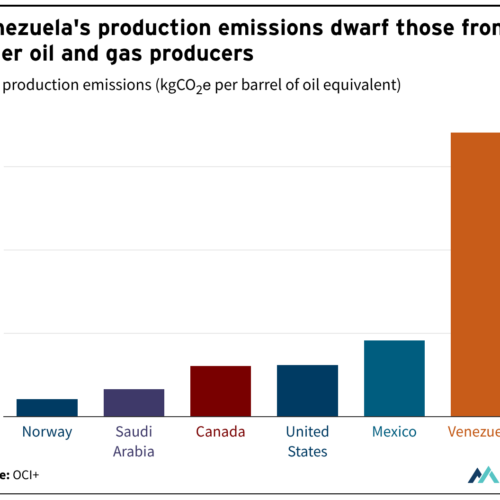

Venezuela's oil is already at a disadvantage among buyers of lower-emissions product.

India

2026

| Article

India’s ability to produce affordable green hydrogen positions it as a decarbonization leader and an anchor of future global clean energy trade.

Electricity

2026

| Article

A review of all integrated resource plans for electric utilities across the United States to evaluate progress toward a clean and secure energy future.

Climate Data

2026

| Article

Methane is a greenhouse gas “super-pollutant” that is 80 times more potent than carbon dioxide over 20 years. We can manage what we measure, but when it comes to methane emissions, we come up painfully…

Climate Data

2026

| 101

As the name suggests, liquefied natural gas (LNG) involves turning gas into liquid form — a process known as liquefaction. Liquefaction does not alter the chemical makeup of gas, which is comprised of mostly methane…